UK Property News & Market Insights

Stay ahead of the market with expert analysis, investment tips, and updates for first-time buyers, landlords, and property investors.

House Prices Firming as Supply and Mortgage Dynamics Shift

UK house prices are rising again, mortgage rates have dropped below 4%, and housing supply is at its highest level in a decade. Here’s what the latest data means for investors, first-time buyers and the wider UK property market in 2026.

One in Nine New UK Properties at Flood Risk

One in nine new UK properties are built in flood risk areas. For property investors, this is not just an environmental issue. It is a growing financial risk that could affect insurance costs, rental yields and long-term portfolio performance.

UK Property Market 2026: The Regional Divide

The latest ONS data shows UK rental growth slowing to 3.5% and house price inflation easing to 2.4%. But beneath the national averages, a clear regional divide is emerging — creating new investment opportunities for buy-to-let investors in 2026.

UK house prices stall: why this is quietly constructive for buy-to-let investors

UK house prices have stalled in early 2026, but elevated supply and improving mortgage affordability are quietly creating opportunity for buy-to-let investors. Here’s what the latest Rightmove House Price Index really means for yields, negotiation power and regional strategy.

The Rise of Multi-generational House Shares - What It Means for Investors

Multigenerational house shares are rising across the UK as affordability pressures reshape rental demand. With nearly 40% of shared households now spanning generations and over-45 renters increasing significantly, buy-to-let investors must reassess rental yields, HMO strategy and single-let positioning in the UK property market 2026.

The Mortgage Reset: Why 2026 Could Reshape Investor Demand

With 1.8 million fixed-rate mortgages resetting in 2026 and high-LTV lending expanding, the UK housing market is entering a lending-led phase. First-time buyers may borrow up to 6x income, while investors face refinancing and affordability challenges. Understand the numbers, plan ahead, and explore our investment and first-time buyer calculators to future-proof your decisions.

By 2030, 58% of UK Rental Properties Could Be Unrentable

By 2030, over half of UK rental properties could be unrentable if they fail to meet EPC C standards. Discover what the Warm Homes Plan and Decent Homes Standard mean for landlords and investors, how many properties are currently below EPC C, and the steps you can take today to future-proof your portfolio against compliance risks and lost income.

“UK Rents Are Falling.” Just Another Headline

‘Rents are falling’ is a headline — but the reality is more complex. Rightmove, Hamptons, Zoopla, and ONS data show advertised, agreed, and average rents moving differently across regions. This 2026 guide explains the true state of the UK rental market and what buy-to-let investors need to know.

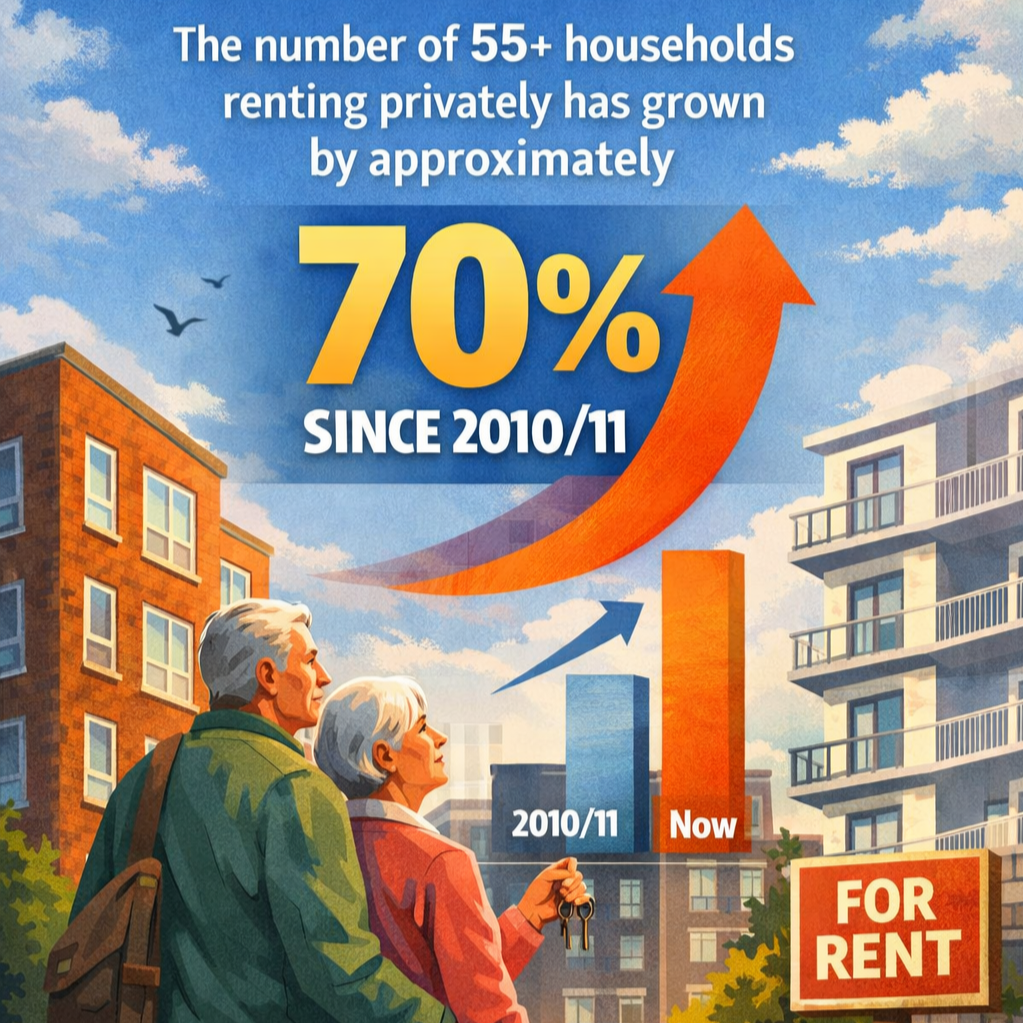

Rising Demand Among Older Renters

The UK rental market is evolving, with households aged 55+ growing rapidly. Nearly 867,000 older renters now occupy private rentals, up 70% since 2010/11, creating long-term, stable demand. Investors can capitalise on age-appropriate, accessible properties, filling supply gaps, securing reliable rental income, and benefiting from structural demographic shifts shaping the UK property market.

UK Housing and Construction Enter 2026 Under Pressure

Explore the latest UK housing market and construction trends in 2026. Taylor Wimpey and Persimmon report rising completions, yet overall construction output falls for the 12th month. RICS survey shows weak activity but improving confidence. Discover what this means for property investors, rental demand, supply constraints, and capital growth opportunities.

UK New Towns

Explore the UK government’s 2026 new towns programme, including 12 potential locations, distinctions between expansions and standalone towns, and expert warnings on affordable housing. Learn about the historical context of post-war new towns, delivery risks, infrastructure challenges, and what investors need to know about the impact on housing supply, regional growth, and long-term opportunities.

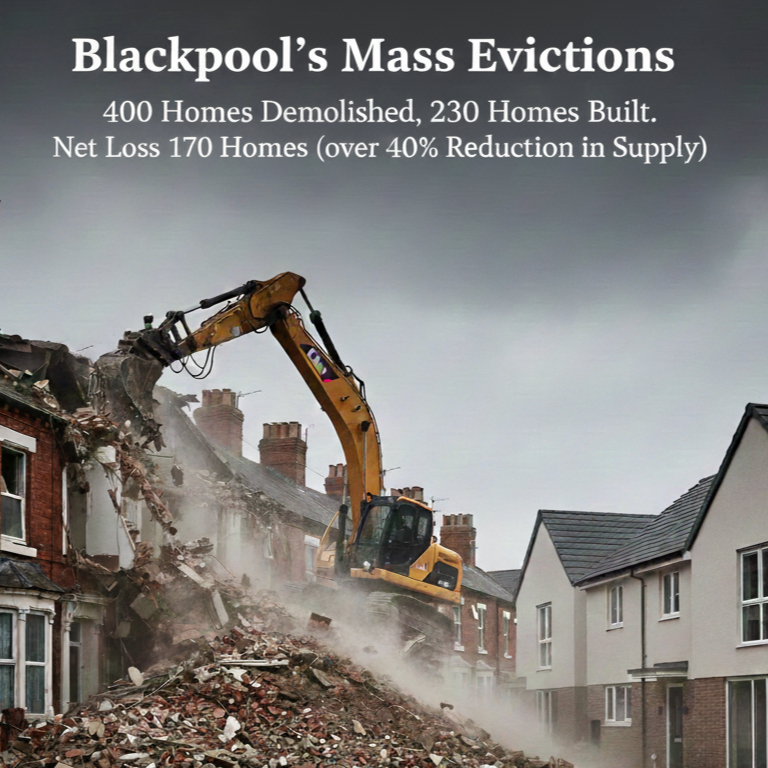

Blackpool’s Mass Evictions

Blackpool’s 2026 regeneration plans will demolish 400 homes, replacing only 230, reducing housing supply by over 40%. With one of the lowest levels of social housing in England and nearly 12,000 households on the waiting list, investors must understand displacement, rental pressure, affordability risks, and long-term market impacts. Data-led insights for UK property investment decisions.

Government Softening Green Rules for New Homes?

Ministers may scale back the Future Homes Standard, dropping mandatory battery storage in new builds. This could reduce long-term energy efficiency, grid benefits, and property value. Investors should stress-test assumptions, budget for future retrofits, and prioritise energy-efficient, tenant-focused strategies to safeguard returns and maximise long-term asset performance.

UK Housing Market Outlook 2026

UK house prices are set for steady growth in 2026 as affordability improves and first-time buyers return to the market. Explore regional price performance, London and prime market trends, mortgage affordability shifts, rental pressures and expert forecasts through to 2028. A clear, data-led outlook for UK homebuyers, landlords and property investors planning their next move.

UK House Price Forecast 2026

UK house prices are forecast to rise by 2–4% in 2026, according to Nationwide, with Rightmove and Halifax also predicting modest growth. Falling interest rates, improved mortgage affordability, stabilising transaction volumes, structural undersupply and strong rental demand are expected to support the UK housing market and property investors.

Record First-Time Buyer Mortgages: What the Data Really Tells Us About the UK Property Market

Discover how record first-time buyer mortgages in the UK are reshaping the property market for buyers and investors. Explore borrowing trends, regional price variations, London market activity, rental demand, family housing, and policy impacts. Learn how to make informed property decisions, maximise rental income, and capitalise on high-demand segments and value pockets in 2026.

First-Time Buyers Are Paying 191% More Than Their Parents

First-time buyers in the UK are paying 191% more than their parents did, with rising house prices, larger deposits, and stricter mortgage rules widening the affordability gap. Property Like A Pro explores the generational shift, the impact on buyers and the wider property market, and what these trends mean as the UK housing market heads into 2026.

Major Shake-Up as Government Prepares to Publish Landmark Commonhold Bill

The UK government is preparing the landmark Leasehold and Commonhold Reform Bill, set to end new leasehold flats and introduce stronger commonhold ownership. With escalating ground rents, opaque service charges, and block management issues under scrutiny, this historic reform will reshape flat ownership, affecting buyers, sellers, investors, and leaseholders across England and Wales.

Institutional Landlords Are Quietly Redrawing the UK Rental Market Map

Lloyds is rapidly expanding its rental portfolio, reshaping the UK property market and increasing competition for private investors. Discover what this shift means for yields, strategy and future opportunities — and learn how investors can stay ahead with smart sourcing and data-driven property decisions.

Budget 2025: What Landlords Need to Know About Property Income Tax Changes

The Autumn Budget 2025 increases property income tax rates to 22%, 42%, and 47% from April 2027. Landlords may face lower net rental yields and rising rents. Discover how this change affects small-scale and portfolio investors, with insights from the OBR, RICS, and buy-to-let lending trends. Plan your strategy with expert guidance.